This overview is based on IRIBA Working Paper 11: ‘Taxation, redistribution and the social contract in Brazil’ by Marcus André Melo, André Canuto Coelho and Armando Barrientos.

Political change and tax reform

Historically, Brazil has avoided both the resource curse and exposure to the ups and downs of a globalising world economy, which have affected many Latin American countries.

Furthermore, Brazil has shown longstanding capacity to collect tax revenue. As part of its state-building effort, the military enacted major tax reform in 1966, introducing innovative measures that had a strong fiscal impact. Brazil adopted a modern tax code, became the first country to introduce value-added taxes (VAT) and revamped its tax administration. In the following seven years, the tax burden doubled as a percentage of gross domestic product (GDP), reaching

26 per cent in 1971.

There were no significant tax reforms in the 1990s and 2000s to explain the rapid increase in taxation in this period. The implementation of inclusion policies following the 1988 Constitution was financed by earmarked social contributions, which the federal government did not have to share with state governments or municipalities. The changes in the tax rules in the democratic period have been incremental. They typically reflect technically-driven, marginal efficiency improvements and piecemeal responses to advocacy by pressure groups.

Proposals for more substantial tax reform have failed to secure approval by the legislative. This is in part because comprehensive reforms would require changing the Constitution, which has discouraged significant changes. Successive governments have opted to maintain a regressive, and increasingly less efficient, tax system with high extractive capacity in preference to a more efficient system with uncertain future revenues.

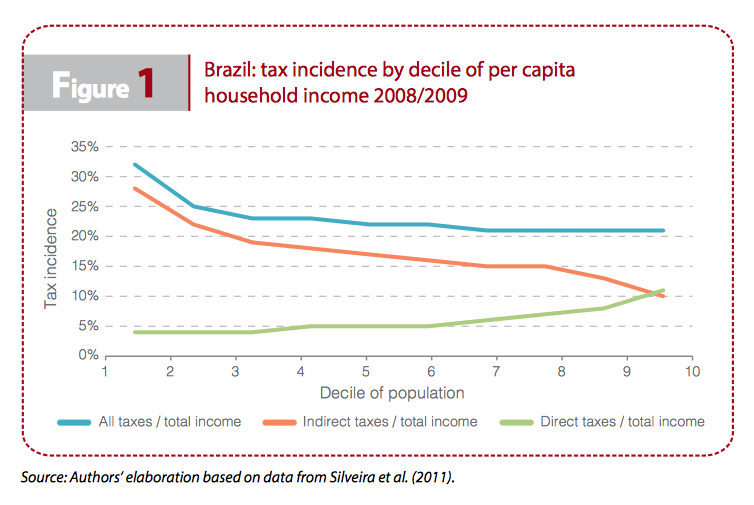

Additionally, policymakers have converged on the view that redistributive objectives are best secured via spending, not taxation. The current Brazilian tax system is beset by complexity and inefficiencies. In distributional terms, the tax system is neutral in the sense that rates of tax are roughly similar across the income distribution, as shown in Figure 1. The progressivity of direct taxes is neutralised by the regressivity of indirect taxes.

The structure of Brazil’s tax system

The 1988 Federal Constitution provides the institutional framework for the current Brazilian tax system. The Constitution assigns tax competencies to the different tiers of government, allowing the imposition of taxes on a wide range of economic activities as well as revenue-sharing schemes.

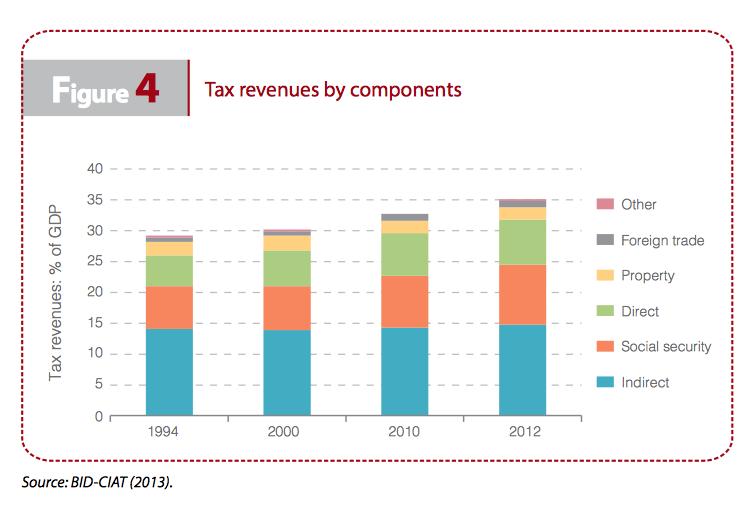

In 2012, tax revenues amounted to 36.3 per cent of GDP, the bulk of which was collected by the federal government (25.38 per cent), followed by the state governments (8.96 per cent) and the municipal government (1.93 per cent) (IBPT 2012).

The tax system consists of taxes, fees and contributions. The so-called contributions (contribuições) are levied on payrolls, but also on employers’ profit, as well as on lottery winnings, government revenues and licensing. The complexity of Brazil’s tax system is a consequence of the proliferation of taxes covering a common base.

The most important federal taxes are the income tax and tax on manufactured goods (IPI), which account for over 90 per cent of federal revenues. The personal income tax is levied on the income and proceeds of any nature earned by Brazilian-based individuals at a progressive rate of 15 per cent or 27.5 per cent, contingent on the taxpayer’s ability to pay.

Corporations pay a 15 per cent Corporate Income Tax (IRPJ), based on their actual or estimated earnings, or on earnings ascertained by the tax authorities. The IPI is a value-added, single-stage tax on production collected based on the sales price when a product leaves the manufacturing stage, or on import, at a rate dependent on the classification of the product.

Additionally, the federal government collects a Tax on Financial Transactions (IOF), comprising credit, foreign exchange, insurance and security operations.

The states collect their own VAT (the ICMS), which is imposed on sales of goods and carrier/telecommunications services. The ICMS represents over 20 per cent of total tax revenue (a significant 7.22 per cent of GDP). In turn, municipalities collect taxes on services (ISS), urban property (IPTU) and transfers of real estate ownership.

The politics of the recent rise in the tax/GDP ratio

The rise in the tax/GDP ratio in Brazil has not been the result of radical tax reform or improvements in tax administration. This suggests that policy models are of less relevance than political factors in explaining the rise. Political consent to the rise in tax revenues is linked to the renewal of Brazil’s social contract after democratisation.

The extension of the vote to illiterates in 1985 incorporated a large share of the population in informal and low-income employment. In line with median voter models, there was increased pressure for redistribution, set against a context of wide polarisation and vast inequalities within society. Political competition and the influence of large governing coalitions from the left and centre-left helped translate popular demand into effective redistribution policies.

The ramping up of social pressure was a necessary but insufficient condition for sustained redistribution to occur. Fiscal sustainability and institutional capabilities were also a fundamental component of reducing inequality. Defeating hyperinflation, with prudent fiscal policies set against a context of rising tax revenues, enabled a balanced approach to redistribution. Political incentives responded to the new fiscal contract.

How sustainable is the fiscal contract?

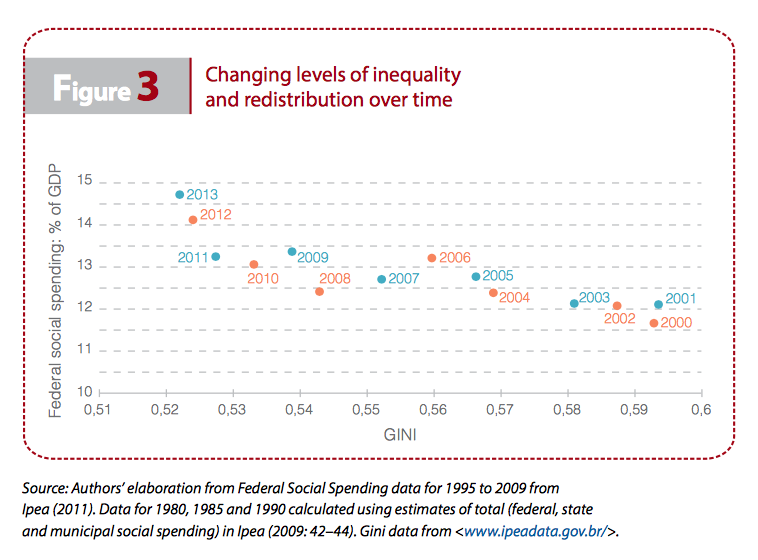

Economic growth and the rise of the tax/GDP ratio in Brazil have enabled successive governments to expand inclusive social policies without the need to reallocate resources from existing programmes and, therefore, avoid damaging conflict. An enhanced fiscal space has enabled social policy activism without undermining pre-existing entitlements.

However, this approach has been placed under stress as the space for tax-and-spend policies has diminished with a slowing economy. According to data from Latinobarómetro, taxpayers have become increasingly disgruntled by high taxes. More Brazilians agree that taxes are too high than any other nationality in the region.

Members of the middle classes have been described as having a ‘dissatisfied customer’ relationship with the State (Daude and Melguizo 2010); they are not satisfied by the quality of public services they receive for their contribution in practice.

Low-income households have become increasingly aware of high taxation. Some 66.7 per cent of Brazilian respondents to the Latinobarómetro survey in 2011 agreed that taxes were too high.

Brazil is now at a critical juncture. The high level of taxation, the politicisation of the issue and the pressures for better quality in public services are engendering a new accountability. This may see people demand less corruption and better services in exchange for tolerating high taxes, but the final outcome is far from certain.

Policy implications

The Brazilian experience may help to better inform taxation and redistribution policies in other countries. Some key findings include reiterating that:

- Governments that want to increase their tax/GDP ratios should not take a purely technocratic approach, but should strive to establish a strong social contract with citizens, based on a shared vision of society;

- Reforms to the tax code require the institutional capacity to implement them, and may take decades to realise their full potential; and

- It is feasible to prioritise redistribution through spending, rather than taxation, but this may result in public dissatisfaction over time.

___________________________

References

Alston, L.J., M.A. Melo, B. Mueller, and C. Pereira. 2012. ‘Changing Social Contracts: Beliefs and Dissipative Exclusion in Brazil’. NBER Working Paper, No. 18588. Cambridge, MA: National Bureau of Economic Research.

BID-CIAT. 2013. Carga Fiscal Ajustada de América Latina y el Caribe 1990–2010. Washington, DC: BID-CIAT.

Daude, C., and A. Melguizo. 2010. ‘Taxation and More Representation? On Fiscal Policy, Social Mobility, and Democracy in Latin America’. Development Centre Working Paper, No. 294. Paris: OECD.

Higgins, S., and C. Pereira. 2013. The effects of Brazil’s high taxation and social spending on the distribution of household income. New Orleans, LA: Tulane University.

IBPT. 2012. 2012 Carga Tributária Brasileira. São Paulo: Instituto Brasileiro de Planejamento Tributário.

Latinobarómetro. 2011. ‘Latinobarómetro 2011 database‘. Santiago, Chile: Corporación Latinobarómetro. Accessed 6 November 2015.

Melo, M.A. 2007. ‘Institutional weakness and the puzzle of Argentina’s low taxation’. Latin American Politics and Society, 49(4): 115–148.

Melo, Marcus, Armando Barrientos, and André Canuto Coelho. 2014. ‘Taxation, redistribution and the social contract in Brazil‘. IRIBA Working Paper, No. 11. Manchester: International Research Initiative on Brazil and Africa. Accessed 6 November 2015.

Silveira, F.G., J. Ferreira, J. Mostafa, and J.A. Ribeiro. 2011. ‘Qual o impacto da tributação e dos gastos públicos sociais na distribução de renda do Brasil? Observando os dois lados da moeda’.

In Progressividade da Tributação e Desoneração da Folha de Pagamentos, edited by J.A. Ribeiro, A.J. Luchiezi and S.E.A. Mendonça. Brasìlia: Ipea.