This overview is based on the journal article ‘The life-cycle of national development banks: The experience of Brazil’s BNDES’ by Ernani Torres, Luiz Macahyba and Rodrigo Zeidan.

The transformation of the Brazilian credit system

Until the mid-2000s, credit in Brazil was characterised by five salient features:

- volatility;

- high costs;

- high concentrations in the banking industry, with the significant participation of state-owned institutions; and

- segmentation, with large quasi-fiscal funds earmarking credit for investments.

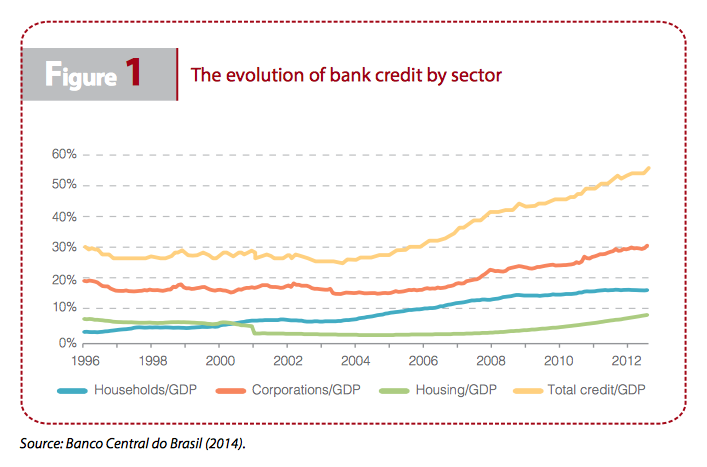

Today, the Brazilian financial market is very different from that of the early 2000s. According to the World Bank (2013), domestic credit to the private sector reached 61 per cent of Gross Domestic Product (GDP) in 2011, above the world average of 58 per cent. This transformation was concentrated on the second half of the 2000s and was centred on households and within the housing market.

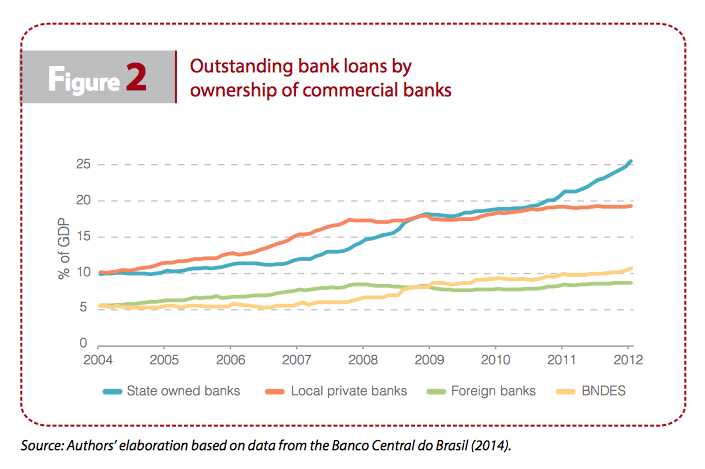

From the supply side, the rapid growth of the credit market from 2004 to 2008 was initially led by domestic private banks. They were liquid and sufficiently capitalised to meet the demand, while the state-owned banks lagged behind. They were financially healthy—but too slow to introduce new financial products to compete with the private sector.

After the bankruptcy of Lehman Brothers in September 2008, the situation changed. Private banks became more cautious and decided to curb the expansion of their lending rates. In order to avoid a recession in the manufacturing sector that would result in massive job losses, the government decided to step in. Banco do Brasil, a state-owned commercial bank, expanded its lending to compensate for the retreat of its private competitors. At the same time, the Brazilian Development Bank (BNDES) increased its disbursements, guaranteeing the flow of funds to long-term projects. These measures helped stabilise the level of domestic investment.

The role of BNDES

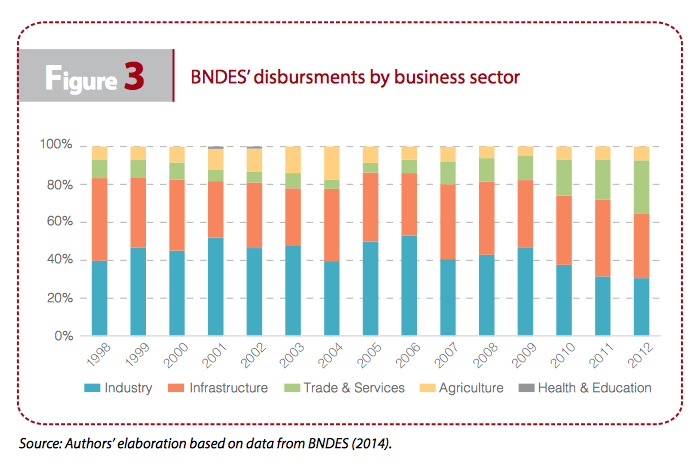

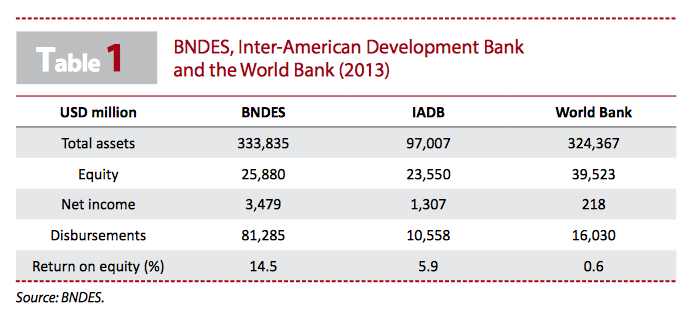

BNDES was created in 1952 as an institutional innovation in the Brazilian banking system to fill an important gap: the provision of long-term loans for investment in manufacturing and infrastructure projects. The shortage of bank loans was considered one of the most important barriers to economic development. It is wholly controlled by the federal government, and today BNDES is one of the largest development banks in the world. It holds almost the same level of assets as the World Bank, but disburses five times more and is much more profitable.

In the 1980s, BNDES started to fund social infrastructure projects in areas such as education, health, water and sewage, and urban transportation. In the 1990s, export finance was also included in its portfolio. However, its core business is still long-term finance—predominately loans but also equity—invested in manufacturing and infrastructure projects.

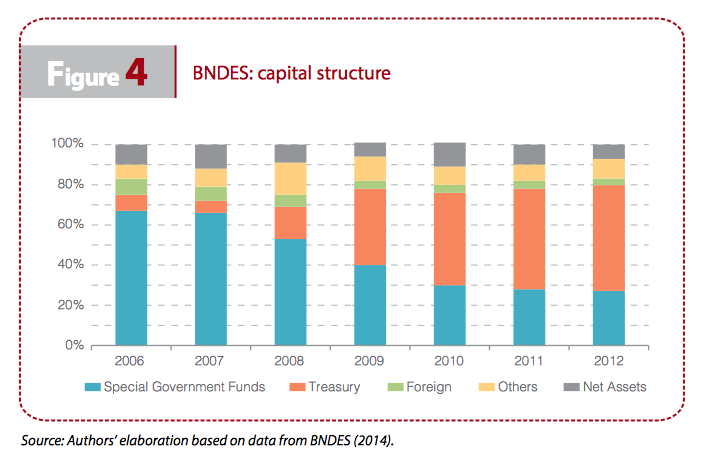

BNDES has always been mainly funded by the public sector. Foreign resources were deliberately minimised to ensure independence from overseas political pressure, as well as to insulate it from international financial markets. Domestic private-sector funding was too scarce, short-term and costly to play a significant role. Therefore, most of the resources managed by BNDES came from the government sector by means of special funds. However, after the 2008 crisis, Treasury loans became increasingly important to leverage sufficient funding to offset the credit squeeze in the private sector. These loans rapidly became the main source of funds for BNDES.

BNDES in Africa

BNDES began to finance Brazilian exports to Africa in 2007. Between 2007 and 2010, credit to the continent totalled more than USD2 billion. Angola was by far the most important destination for loans, along with other Portuguese-speaking countries and South Africa. The loans were related to investment projects in different sectors—including roads, power (generation and transmission lines), water and sewerage systems, and airports—that were awarded to large Brazilian private construction companies.

National development banks as a tool to promote investment, growth and stability

National development banks are a polarising subject. On the one hand, critiques highlight that loans have a high level of state subsidies, a lack of transparency and a tendency to privilege certain economic groups; on the other hand, national development banks clearly address a market failure in the long-term credit market.

In Brazil, BNDES has been an important purveyor of long-term credit and facilitator to capital market development, an agent for anti-cyclical responses to possible crises and an external financier to the internationalisation of Brazilian companies. However, there is evidence that when the bank strays from its main roles, it does not generate value for shareholders—especially when it is a minority shareholder in non-financial companies.

Policy implications

National development banks may not be necessary when financial markets are efficient and well established. But that is far from the reality of emerging markets, especially the poorer countries in the world.

The World Bank estimates that in infrastructure alone the growth in demand from developing countries will increase by around an additional USD1 trillion per annum through 2020. This is especially true in Africa, in which long-term financing is particularly precarious.

National development banks—such as BNDES—can be important institutions for the industrialisation and development process while financial markets mature, but become less relevant as financial markets develop. While such institutions offer potential advantages to economies with less mature financial sectors (a situation typical of many sub-Saharan Africa economies, for example), their establishment involves significant resource costs. Whereas Brazil has been able to meet this challenge through reasonably good access to international capital markets and robust streams of taxation revenue, it should not be imagined that these conditions would always apply to other economies, especially those at an early stage of development. In setting up its own national development bank, Brazil was able to draw on a reasonably deep pool of local expertise and talent—an advantageous state of affairs not necessarily characteristic of many developing economies.

___________________________

References

Banco Central do Brasil. 2014. ‘Time Series‘. Accessed 27 October 2015.

BNDES. 2014. Desembolso Anual do Sistema BNFRS. Brasìlia: Brazilian Development Bank. Accessed 27 October 2015.

Garcia, M. 2010. The Financial System and the Brazilian Economy during the Great Crisis of 2008. Rio de Janeiro: ANBIMA.

Oliveira, Fernando Nascimento de. 2013. ‘In-Depth Analyses of Investment of Firms in Brazil: Do Financial Restrictions, Unexpected Monetary Shocks and BNDES Play Important Roles?’ Paper presented to the Brazilian Econometric Society Forum. Accessed 5 November 2015.

Torres, Ernani, Luiz Macahyba, and Rodrigo Zeidan. 2014. ‘Restructuring Brazil’s National Financial System‘. IRIBA Working Paper, No. 6. Manchester: International Research Initiative on Brazil and Africa. Accessed 5 November 2015.