This overview is based on the journal article ‘Introduction – Is there a Brazilian development ‘model’?’, by Armando Barrientos and Ed Amann.

In the decade and a half since the mid-1990s, Brazil has embarked on a new developmental trajectory in which, for much of the period, reasonable growth performance has been combined with an increasingly effective assault on poverty and inequality. The pro-poor character of economic growth in Brazil during the contemporary era stands in marked contrast to the experience of previous boom periods. Impressive though the record has been over the long term, a number of structural difficulties have not been sufficiently addressed. Partly as a result of this, Brazil is now facing significant challenges as it attempts to boost growth and continue its assault on poverty and inequality.

Analysing the progress made and the obstacles that remain to be tackled, the UK Department for International Development-funded International Research Initiative on Brazil and Africa (IRIBA) has examined key aspects of Brazil’s development experience since the mid-1990s and concludes that a new Brazilian development model has indeed emerged. The key findings are as follows:

1. The Brazilian model is a blend of consensus and conjuncture

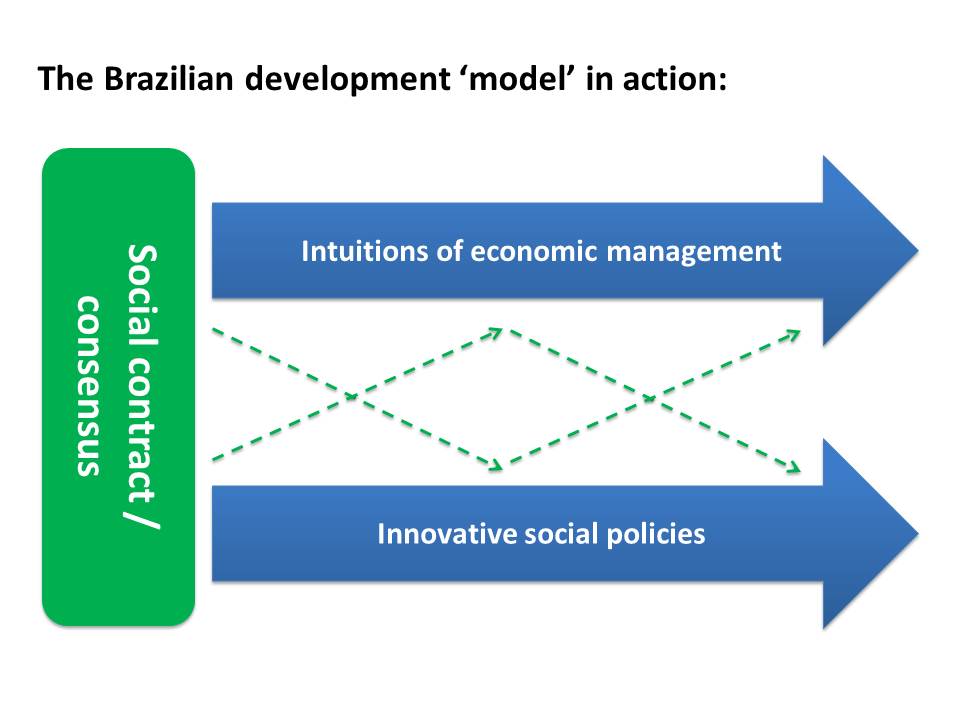

Our assessment is that a unique combination of economic and social policies is primarily responsible for the unexpected success shown by Brazil. There are specific features of the institutions of economic management developed after the stabilisation plan of 1994 which, together with innovative social policies emerging from municipal activism and a favourable social contract, set a new course for Brazil.

A renewed consensus or ‘social contract’ is acutely significant in ensuring the conditions for a positive evolution of these institutions. It ensures that economic and social policies work together, reinforcing each other. This is what we mean by a new ‘model’. Of course, not all policies have always fitted together nicely. Important areas such as infrastructure lacked effective policies, while others such as the effective prosecution of corruption cases were stymied by institutional bottlenecks.

2. Brazil’s development model is based on inclusive growth

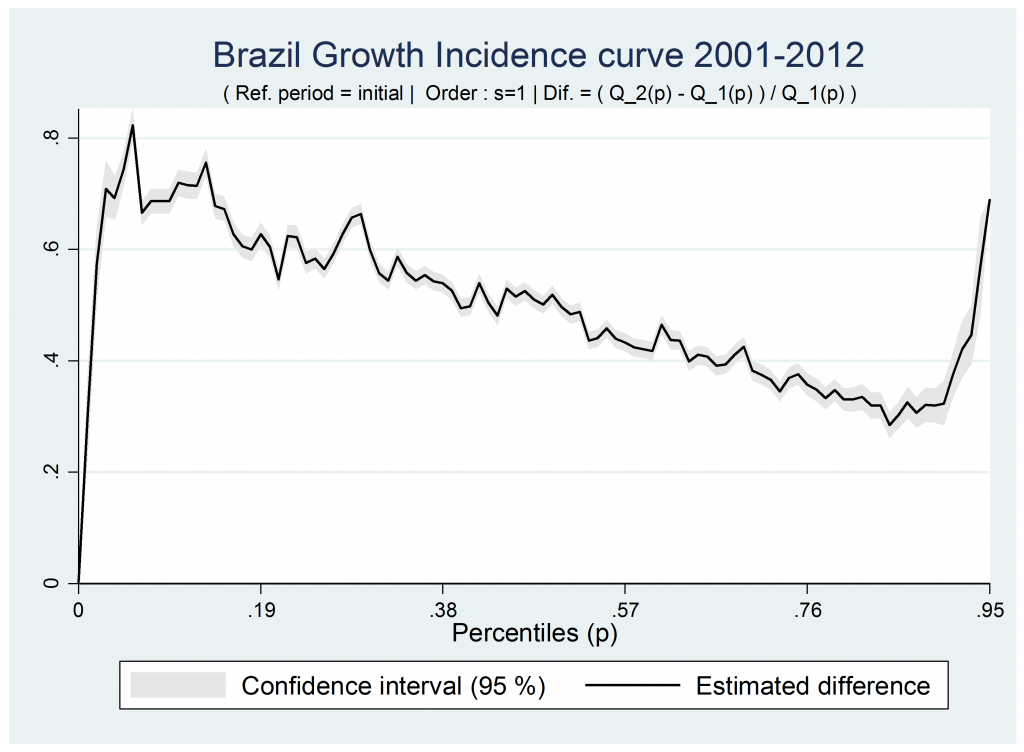

The defining feature of Brazil’s recent economic success is not the fact that the economy grew steadily during the first years of the new century. Gross domestic product (GDP) growth rates have averaged 3 per cent since the mid-1990s; however, Brazil did not achieve rates of economic growth comparable to China or India. Rather, it is the quality of its economic growth that is noteworthy.

The lowest deciles of income grew at Chinese rates, while the wealthiest deciles of income did much less well, growing at Côte d’Ivoire rates. While all sections of society saw their incomes rise, the poorest benefitted most. This has been reflected in declining levels of inequality in Brazil. The Gini index fell from 60.1 in 1997 to 52.7 in 2013 (Ipeadata).

3. Macro stability has underpinned progress

The cornerstone of Brazil’s successful economic transition has been a process of cumulative institutional reforms. These have affected the formulation of fiscal and monetary policy in addition to the operation of the financial sector. Taken together, these reforms have underpinned the price and financial stability, which have in turn facilitated the pursuit of inclusive growth.

The critical turning point in the transition to inclusive growth came two decades ago with the elaboration and implementation of a complex stabilisation plan, the Plano Real (Real Plan), between 1993 and 1994. Introduced to combat hyperinflation, it was introduced gradually and cleverly employed a pegged exchange rate to the US Dollar. Allied with trade liberalisation, this maintained an external check on domestic price formation without stifling growth. The formal currency peg was replaced with an inflation-targetting framework at end of the 1990s.

4. Fiscal capacity and responsibility has been vital

Accompanying the introduction of a new and pegged currency, the Real policymakers added a firmly orthodox plank to their counter-inflationary strategy by setting targets for the fiscal balance. Their strategy combined more effective constraints on public spending with limited reform of the taxation system. The centrepiece of the reform programme was the formulation of a fiscal targetting framework, an institutional innovation which would go on to prove very effective in ensuring the continuation of price stability, while building credibility among foreign investors. The fiscal autonomy of states and municipalities was also reduced, providing an effective constraint on public spending.

Thanks to the effective reform of its financial system, Brazil has seen a considerable expansion of credit to households, to firms and for the financing of an expansion of the housing stock. The expansion of credit has proven an important driver of growth. The Brazilian Development Bank (BNDES) has played an active role, which helped limit the impact of international financial contagion following the collapse of Lehman Brothers.

The tax raising powers of the various levels of government have proven impressive by the standards of emerging market economies, accounting for over 30 per cent of GDP. As growth accelerated following stabilisation, it has consequently been proven possible for the federal government to combine fiscal rectitude with a rise in spending on social programmes.

5. Agriculture has been transformed

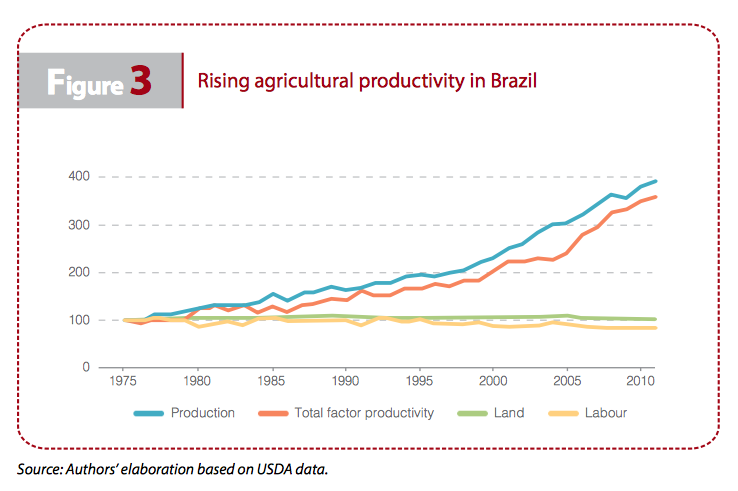

One of the key elements of Brazil’s economic transformation over the past two decades has been the resurgence of agricultural exports. Agriculture has undergone a dramatic transformation, making Brazil one of the major breadbaskets of the world: in 2010 the country was the world’s foremost producer of sugar, coffee, orange juice and poultry, the second largest producer of soybeans, the third largest producer of corn and the fourth largest producer of pork. Yet any notion that the agricultural sector had the potential to become an export dynamo would have seemed highly improbable during the 1970s and 1980s.

Brazil has made dramatic improvements in its agricultural productivity. Whereas the total area of land in agriculture has remained basically the same since the mid-1970s, production has increased by nearly 300 per cent. The surge in agricultural productivity experienced by Brazil has comfortably outstripped that of other countries in the region and has outpaced that of both China and the USA.

While agricultural policymaking had a relatively limited impact on performance of the sector, broader institutional changes exercised a much more important role. The renaissance of Brazilian agriculture should not be considered in terms of the expansion of factors of production alone, but also in terms of institutional and technological innovations—not all of which could be described as sector-specific.

Brazil did not follow a carefully laid out, predetermined strategy whose aim was to turn the country into the international agricultural giant which it is today. It pragmatically adapted its light-touch, market-oriented agricultural policies1 to seize opportunities opening up in both domestic and international markets (Bacha et al. 2014).

6. Brazil shows that the ‘resource curse’ is not inevitable

Brazil has never been dependent on a single commodity, and diversification under import substitution industrialisation met with moderate success in broadening the productive base. Recent export performance shows the effectiveness of exploiting underlying natural comparative advantages in agriculture and minerals as a platform to move up the value chain and develop a successful agro-industry.

A key driver of the productivity gains experienced by the Brazilian agricultural sector has been a strong record of innovation—one area where the State has played an active and consistent role. EMBRAPA, a federally funded agricultural research agency, has been central to funding research and has facilitated research networks linking agricultural producers, research laboratories and private-sector suppliers of agricultural seeds, technology and equipment.

The agricultural transformation of Brazil should not simply be understood in terms of a quantitative increase in production and exports; there have also been qualitative improvements, which have allowed producers to seek out new—and lucrative—market niches, whether domestically or in the global marketplace.

7. Social policy has focussed on inclusion and productivism

Social policy has been a core component of the Brazilian development model, making a significant contribution to inclusive growth. Transfers in kind, as in education, training and health care, and transfers in cash, as in social insurance and social assistance, have been the object of policy activism.

The 1988 Constitution was a watershed moment, enshrining the principle that the government has a responsibility to ensure minimum income security to all citizens independently of their capacity to contribute to social insurance. Two social pension schemes, the Previdência Social Rural and the Benefício de Prestação Continuada, were both established in the mid-1990s. Subsequently, the Lula administration implemented the Bolsa Família programme, which provides regular income supplements for households living in extreme poverty with conditions ensuring children’s school attendance and utilisation of primary health care. Together with rising minimum wages, Brazilian anti-poverty transfers have played an important role in reducing overall poverty and inequality.

The recent increase in social expenditure in Brazil is likely to have a direct effect on growth through its effect on demand. Estimates of the multipliers applying to government expenditure suggest that the focus on disadvantaged groups in the expansion of social policy has had measurable effects on economic growth. The Brazilian Institute for Applied Economic Research (Ipea) has estimated that the GDP multiplier of social expenditure taken as a whole was of the order of 1.37 in the mid-2000s, while the social expenditure multiplier on household income growth rates was higher, at 1.85 (Ipea 2010).

8. Rising tax revenues have been redistributed

Brazil managed a remarkable increase of 7 percentage points in tax revenue as a percentage of GDP between 1995 and 2010, from 26.9 per cent in 1995 to 34 per cent in 2010. This is intriguing because it is not associated with significant changes to the tax code or in tax administration.

IRIBA studies have found that a combination of baseline conditions—namely, strong bureaucratic capacity—and the process of democratisation, partisan competition, fiscally responsible centre-left coalitions, and the executive power created the conditions within which strong preferences for redistribution became embedded in effective social policy.

Social expenditures have received both an absolute and a relative increase in their share of resources. Until recently, the rise in tax/GDP ratio did not provoke public and political contestation, suggesting an underlying association with the social contract in Brazil. However, the recent public interest in tax and tax policy perhaps signals new tensions—and boundaries—of the social contract.

9. Labour market intuitions reduced earnings inequality

Not only have average earnings increased in Brazil, but they have increased the most for groups of workers who used to earn the least. As the most important component of household income, the inequality in labour incomes reproduces the trends of declining inequality in household income. The Gini coefficient of labour incomes declined in Brazil from 0.54 to 0.41, a reduction of just below one-quarter. Demographic and spatial factors, as well as informality jointly account for the bulk of the reduction in the Gini coefficient of labour incomes in Brazil. The decline in earnings inequality can be attributed to lower gender and race wage gaps, and to lower urban and regional wage premiums.

10. There are limitations to this new Brazilian model

In the last few years, a variety of signals suggest that the Brazilian model could be encountering more significant constraints. While the initial impact of the global financial crisis was muted, it arrived in Brazil later through other channels: the slowdown of growth experienced by the Chinese economy and other emerging economies added to the fall in demand for commodities associated with recession and austerity in high-income countries.

There is growing public concern with the incidence of taxation and the destination of government expenditure, which spilled over into opposition to the infrastructure investment associated with the 2014 FIFA World Cup. The eruption of popular protests in mid-2013, prior to and during the tournament, as well as the political and economic crises of 2015 serve to underline the fact that Brazil’s economic and social reforms are still very much works in progress.

There is a strong case for further fiscal reform in Brazil—an area where the initial impetus of reform of the 1990s has notably slowed down. In the field of infrastructure (a central issue in the 2013 demonstrations), sustained failure to finance and effectively regulate has led to significant deficiencies in transportation and communications networks. The uncovering of serious graft and corruption surrounding major projects in the energy sector now presents a further obstacle to sustained infrastructure planning and investment.

While there is a tightening of conditions in the policy environment, in some areas the model appears resilient. It is perhaps too early to assess whether the current conjuncture will lead to significant changes in Brazilian economic and social policy, and its aim to stimulate inclusive growth. Further progress here will be contingent on meaningful structural reform in critical areas such as education, infrastructure and fiscal policy. However, in the short term at least, the political consensus needed to push through such reforms appears to be lacking. Adding to Brazil’s difficulties, prices for its key commodity exports remain subdued. Thus the prospects for a sustained resumption of growth via external stimulus are limited.

References

Amann, Ed, and Armando Barrientos. 2014. ‘Is there a new Brazilian model of development? Main findings from the IRIBA research programme‘ IRIBA Working Paper, No. 13. Manchester: International Research Initiative on Brazil and Africa. Accessed 10 November 2015.

Bacha, Carlos, and Leandro Vinicio de Carvalho. 2014. ‘What explains the intensification and diversification of Brazil’s agricultural production and exports from 1990 to 2012?‘ IRIBA Working Paper, No. 2. Manchester: International Research Initiative on Brazil

and Africa. Accessed 10 November 2015.

Ipea. 2010.’Efeitos Econômicos dos Gastos Sociais no Brasil’. In Perspectivas da Política Social no Brasil, edited by Ipea, 8: 109–162. Brasìlia: Ipea.

Ipea. ‘Ipeadata‘. Accessed 10 November 2015.

USDA. 2015. ‘Economic Research Service: International Agricultural Productivity‘. Accessed 10 November 2015.

Footnotes

1. Such policies include support for agricultural innovation and the provision of official investment financing for larger agricultural enterprises.