This overview is based on the journal article: ‘Infrastructure and its role in Brazil’s development process’ by Edmund Amann, Werner Baer, Tom Trebat and Juan M. Villa.

Historical problems

Until the 1930s, federal government involvement in infrastructure projects in Brazil was almost non-existent. Faced with thin domestic capital markets and a narrow tax base, local policymakers were obliged to draw heavily on inward foreign direct investment (FDI) to meet Brazil’s fast expanding infrastructural requirements. Infrastructure projects were largely built and operated via concession contracts with companies.

As Brazil moved into the 1940s and 1950s, the State took on an increasing role as a direct provider of infrastructure in the transportation, power generation and distribution, and water and sanitation sectors. The progressive transfer of infrastructure to public ownership reflected not only the need to inject investment where the private sector had been unable or unwilling to do so but also an ideological shift that permeated Brazilian economic affairs. While significant improvements were achieved in power-generating facilities and some highways, other elements of infrastructure such as railroads were largely neglected.

During the ‘lost decade’ of the 1980s, when Brazil underwent a serious debt crisis, investments in infrastructure withered. By the early 1990s, Brazil faced the necessity of substantially modernising its infrastructure sector. From the second half of the 1990s, Brazil’s policymakers were forced to confront the fact that the only way to deal with the need for infrastructure investment was to revert to the old model of appealing to the private sector through concession contracts or by offering public–private partnerships.

Investments in infrastructure will boost growth

New econometric analysis1 of regional and municipal data from Brazil demonstrates that infrastructure spending has a positive effect on local gross domestic product (GDP) growth. If Brazilian states increase their infrastructure spending by 1 per cent, the regional GDP growth rate would increase by 0.11 per cent per year, while the GDP per capita growth rate would respond with an increase of 0.072 per cent per year. Investment in transport infrastructure is likely to yield better results than investment in communications or energy.

Contemporary challenges

The most recent World Economic Forum (WEF) Global Competitiveness Report (2013–14) ranks the quality of Brazil’s infrastructure as 114th out of 148 countries. Clear shortcomings exist in all sectors:

Roads

By 2011, although Brazil had the world’s fourth largest road network, there remained significant quality issues associated with it. According to a World Bank (2012) study, only 18 per cent of Brazil’s 1.75 million kilometres of highway are paved. This represents an especially significant deficiency, bearing in mind that 60 per cent of Brazil’s freight moves by road. As a result, spending on logistics represents a comparatively high 15.4 per cent of GDP. (WEF quality ranking: 120/148 countries).

Rail

Unlike in other key emerging market economies, including China and India, rail transportation is almost exclusively the preserve of commercial freight. Freight itself is heavily dominated by iron ore, which accounts for 79 per cent of total rail cargo. Passenger rail is the almost-exclusive preserve of a small network of commuter lines around Rio de Janeiro and São Paulo. (WEF quality ranking: 103/148 countries).

Ports

For an economy heavily dependent on exports of natural resources-based products, Brazil suffers to a surprising extent from quality and capacity limitations of its port infrastructure. Brazilian ports handle 95 per cent of the country’s trade by volume and 85 per cent by value. Delays in loading, unloading and customs clearance mean that trucks frequently spend hours (sometimes days) queuing outside ports. Ships are forced to wait much longer to dock than in other countries in the region, while costs are also higher. (WEF quality ranking: 131/148 countries).

Air

The physical scale of the country, the absence of long-distance rail services and the poor quality of highways infrastructure outside the South and South East regions of the country mean that Brazil is highly reliant on air transportation. Here, as elsewhere, the infrastructure is associated with a legacy of under-investment and poor connectivity, placing Brazil at a disadvantage in terms of international trade, investment and tourism. (WEF quality ranking: 123/148 countries).

Water and sanitation

Only 80 per cent of the Brazilian population have access to ‘improved sanitation facilities’, compared to 83 per cent in South America overall and 97.5 per cent for Organisation for Economic Co-operation and Development (OECD) countries. Only 47 per cent of the population is provided with sewage collection and disposal.

Government response

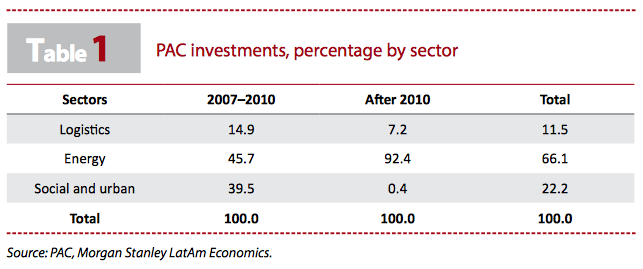

Since 2007, the authorities have been attempting to engineer a step change in the scale and quality of infrastructure across a range of strategic sectors. This effort, known as the Growth Acceleration Programme (Programa de Aceleração do Crescimento—PAC), envisages significantly increased investments in highways, railways, energy, air transportation, telecommunications, housing, water and sanitation. The focus of the programme is concentrated on the energy, social and urban sectors, as Table 1 reveals. Within the social and urban investments there is a significant focus on housing finance.

PAC 1 (2007–2010) envisaged spending BRL503.9 billion, while the more ambitious PAC 2 (2010–2014) proposes spending BRL958.9 billion over its lifespan (around 2.7 per cent of 2010 GDP per year), with a further BRL631.6 billion in investments planned beyond 2014.

With the policy decision to tackle Brazil’s legacy of ingrained underspending on infrastructure, two things became obvious: first, that the State did not have the technical or managerial means to accomplish these projects by itself; and, second, that it did not have the financial wherewithal to see these projects through to their completion. It was thus decided to turn to two models: public–private partnerships and the longer-established model of concession contracts.

The programme has come under criticism for not delivering on its ambitious targets sufficiently rapidly. A brief review of the data suggests that these concerns may be overblown. Between the beginning of 2007 and the end of 2010, 82 per cent of planned PAC 1 projects were completed, with public investment rising to 3.2 per cent of GDP, compared with around 2 per cent prior to the programme’s launch.

Data released in February 2014 show that 82.3 per cent of PAC 2’s projects had been completed by the end of 2013, with accumulated spending reaching BRL773.4 billion or 76.1 per cent of the programme’s total budget. Despite the scale of the programme’s achievements in overall terms, it remains true that investment in certain critical sub-sectors (notably, urban transportation and sanitation) have suffered significant delays.

Perhaps the most glaring obstacle to accelerated progress has centred on the delayed issuance of environmental permits. The delays here have largely concerned the slow operation of dispute-resolution procedures and the licensing mechanisms, rather than the environmental regulatory provisions themselves.

Furthermore, corruption remains a major issue, with estimates suggesting that Brazil lost BRL40 billion between 2002 and 2008. Most of this was attributed to the infrastructure sector.

Policy implications

The Brazilian experience with infrastructural development illustrates the scale of the challenges that may need to be overcome if developing economies are to attempt to realise step changes in the quality and extent of their transportation, energy and communications networks. Our research underscores just how important infrastructure is for growth, competitiveness and trade. Under-investment can severely retard progress, yet addressing a legacy of decades of under-investment is a huge challenge. Not only this; access to good-quality, affordable infrastructural services is increasingly an issue of real political salience. In tackling this issue the role of the foreign private sector is key, given fiscal constraints and thin domestic capital markets. There will be regulatory conflicts between the need to incentivise investment and the need to address social objectives. Effective regulation is not just about balancing the interests of investors and consumers; it is about ensuring predictability of the de facto regulatory arrangements and speed in decision-making. Finally, efforts to ramp up infrastructural spending need to take into account the availability of domestic technical capacity. This can be spread very thinly once projects begin to multiply.

___________________________

References

Associação Nacional de Transportes Públicos. 2007. Relatório Geral 2006. São Paulo: Associação Nacional de Transportes Públicos. Accessed 6 November 2015.

Associação Nacional de Transportes Públicos. 2012. Relatório Geral 2011. São Paulo: Associação Nacional de Transportes Públicos. Accessed 6 November 2015.

Economic Commission for Latin America and the Caribbean. 2011. ‘The Economic Infrastructure Gap in Latin America and the Caribbean‘. FAL Bulletin, Issue No. 293, No. 1. Santiago, Chile: Economic Commission for Latin America and the Caribbean. Accessed 6 November 2015.

Economist. 2013. ‘The Road To Hell‘. The Economist, 28 September. Accessed 6 November 2015.

Financial Times. 2013. ‘Brazil Infrastructure‘. FT Special Report, 10 September 2013. Accessed 6 November 2015.

Morgan Stanley. 2010. Brazil Infrastructure: Paving the Way. New York: Morgan Stanley. Accessed 6 November 2015.

PWC. 2013.’Crunch Time for Brazilian Infrastructure‘. Gridlines. Porto Alegre: PWC. Accessed 6 November 2015.

World Bank. 2012. ‘Brazil – How to decrease freight logistics costs in Brazil.’ Transport papers, No. 39. Washington, DC: World Bank.

World Economic Forum. 2013. The Global Competitiveness Report 2013–2014. Full Data Edition. Geneva: World Economic Forum.

Footnotes

1. The main data source for the estimation of this model, derived from Hausman and Taylor, is provided by the IPEAData service, which collects several sources of public data, including regional and municipal information on several topics.